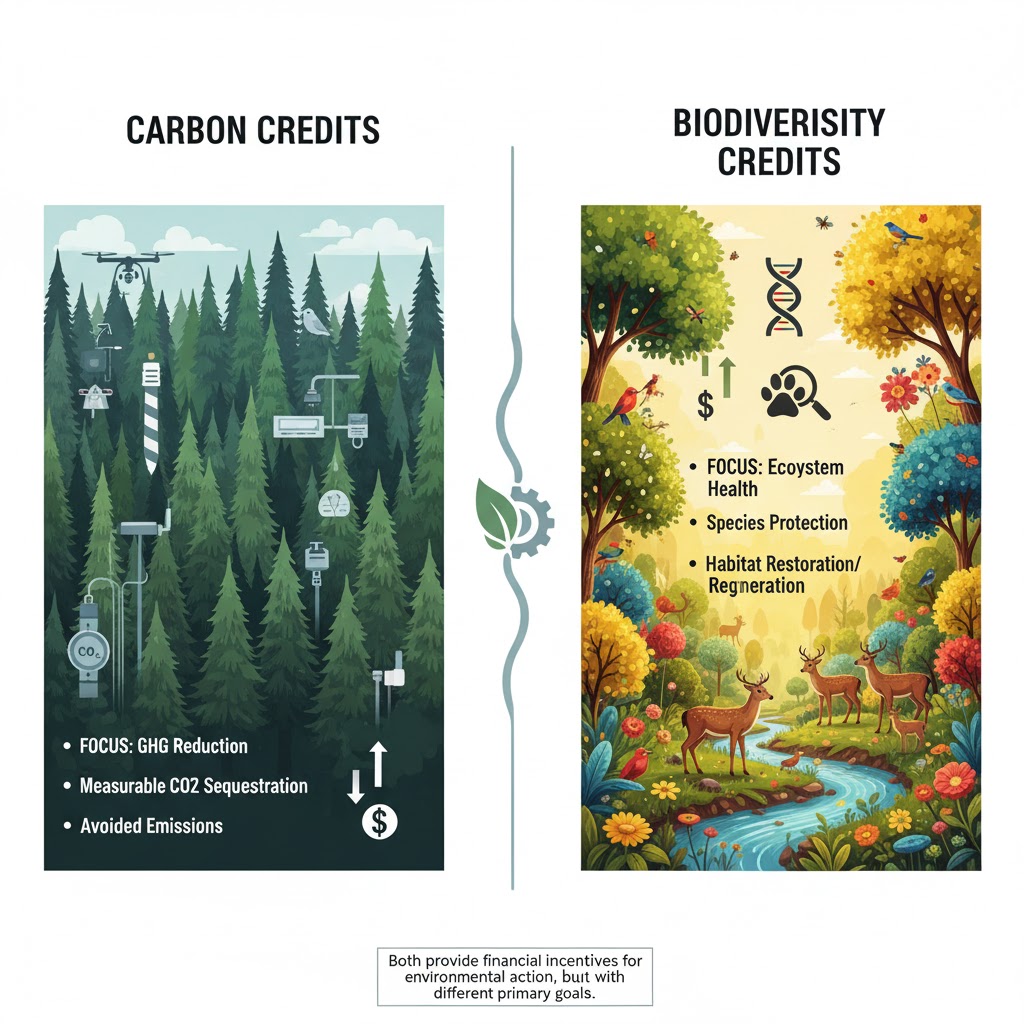

The voluntary carbon market (VCM) is evolving quickly. While carbon credits remain the backbone, a new and exciting trend is gaining momentum in 2025: biodiversity credits. These credits go beyond carbon reduction to protect and restore ecosystems—linking climate action with nature conservation.

Biodiversity credits are units that represent measurable conservation outcomes such as:

* Protection of endangered species.

* Restoration of forests, wetlands, and mangroves.

* Preservation of habitats that safeguard ecosystem services.

Unlike carbon credits, which are measured in tons of CO₂ reduced or removed, biodiversity credits focus on the health and resilience of ecosystems.

According to Ecosystem Marketplace, biodiversity-linked credits could represent a multi-billion-dollar opportunity by 2030.

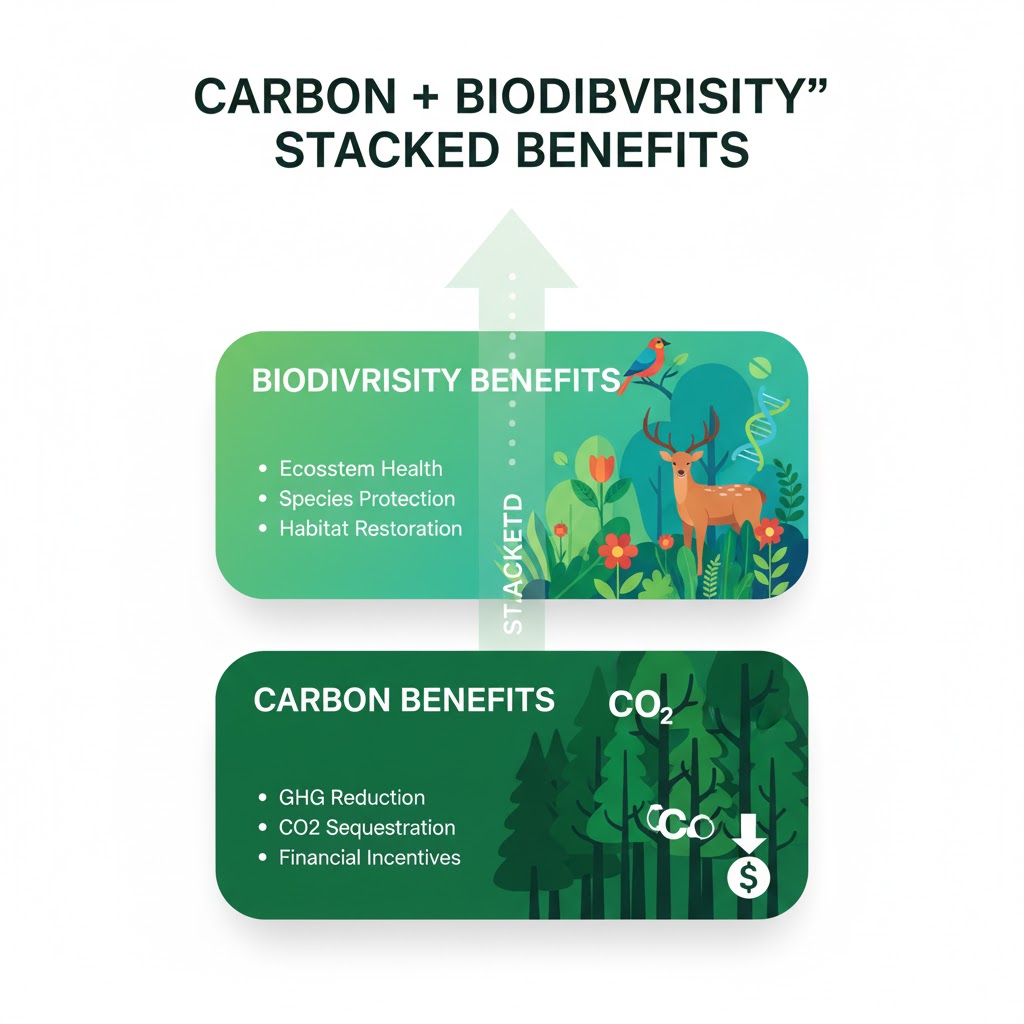

Instead of replacing carbon credits, biodiversity credits are designed to work alongside them.

A forest conservation project can issue both:

– Carbon credits for avoided deforestation.

– Biodiversity credits for protecting species habitat.

This creates a stacked benefits model, rewarding projects for the full scope of environmental value they deliver.

For companies, biodiversity credits offer:

Stronger ESG storytelling – linking climate goals with nature protection.

Brand differentiation – consumers increasingly value biodiversity-positive actions.

Risk mitigation – resilient ecosystems reduce climate and supply chain risks.

Some multinational brands have already begun co-investing in biodiversity alongside carbon projects, positioning themselves as leaders in nature-positive transitions.

The next 2–3 years will determine whether biodiversity credits move from niche to mainstream. Key challenges include:

* Developing robust standards for measurement and verification.

* Avoiding double-counting with carbon credits.

* Ensuring credits deliver real, additional, and lasting benefits.

Still, the momentum is undeniable. As the climate crisis and biodiversity crisis are deeply interconnected, biodiversity credits could become the next big wave in voluntary markets.

Carbon credits may have started the movement, but biodiversity credits are expanding the horizon. For businesses, investing in nature-positive projects isn’t just good for the planet—it’s becoming a strategic advantage.

The voluntary carbon market is no longer just about carbon. It’s about carbon + nature + communities—and biodiversity credits are leading that transformation.

https://www.naturefinance.net/biodiversity-credits/

https://www.weforum.org/agenda/2023/01/biodiversity-credits-nature-carbon/

https://www.naturefinance.net/biodiversity-credits/

https://www.weforum.org/agenda/2023/01/biodiversity-credits-nature-carbon/

https://www.ecosystemmarketplace.com/

Vinod has been an integral part of ClimeTrek since its inception, initially serving as a Marine Advisor before assuming the role of Head of Operations. With a strong background in conducting environmental compliance & safety audits and managing large-scale projects for ships and shore-based organizations, he brings a wealth of experience to the field of environmental management. His dedication to sustainability, environmental stewardship, and the pursuit of innovative solutions makes him a valuable asset in navigating the complexities of the voluntary carbon market, compliance markets like the EU ETS, and the requirements of organizations in three critical areas: environmental impact, social responsibility, and governance practices (ESG).

Academically I have a masters degree in Environmental Engineering from the University of Algarve in Portugal, and a further masters degree in Climate Change from King’s College London. I have joined ClimeTrek in 2021, working in business development, mainly in project sourcing.

I’ve always been very enthusiastic about Environmental issues, specially climate change, and have experienced first hand its impacts in my hometown in the Algarve, where years of severe draught it’s seriously impacting the life in the region. So for me its very motivating to be involved in the projects that ClimeTrek is developing.

Leena has been a member of ClimeTrek Ltd since its inception. She has over 12 years of experience in office management, accounting, and trading. She oversees company policies and procedures, managing financial and accounting processes, analysing market trends, and facilitating carbon trading transactions that drive positive environmental impact. Leena holds a Bachelor’s degree in Finance and Business studies and a Master’s degree in English Literature. In her free time, she enjoys watching Netflix and reading novels.

DK Balian is the Founder and CEO of ClimeTrek Ltd, a leading climate change and sustainability consultancy and carbon project developer. He has over 27 years of experience in the energy sector and is a sought-after speaker on sustainability and maritime issues. With his Master’s in Maritime Law and practical experience, he is uniquely positioned to advise on climate change impacts from both regulatory and practical perspectives. Through his work, DK Balian is committed to creating a sustainable future for generations to come.

George has spent most of his career in and around oil and gas trading. He feels that his work with Climetrek is some attempt to make amends for his earlier career by undertaking projects to protect the environment rather than continue to destroy it. As a committed family man George enjoys spending time at home but is always curious to travel and experience the lives of others. He has a first degree in Accounting and an MBA.

In his role at ClimeTrek, he manages the Business Development team around project origination with key focus in Asia and Africa around technical and commercial feasibility, as well as devising the business strategies of ClimeTrek. In his spare time, he avidly watches football, and dons on a chef’s hat.

Yucel Kirtman is a qualified engineer with several years of diverse experience working on different projects for energy efficiency, biomass power plants, ORC turbines (Turboden). He worked as an engineer for the last field tests before production of all the tires which are either modified or newly designed in Turkey as well as the approval authority of the reclaimed defected tires. He later moved on to work for Borusan Makine which is the exclusive distributor of Caterpillar and Michelin off road tires in Turkey wherein his responsibilities included managing a team of sales people in different regions, setting the sales target, giving technical support to the team, prepare technical material in Drive train spare parts and Michelin off road tires. In 1998, he started to work for Kordsa which was a JV between DuPont and Sabanci Holding. He was responsible for Nylon 6.6 production, maintenance and utilities

He also started his own company, Kırtman Enerji, which is sales agent of Thermal Energy Inc, Ca.

He was also the director of Hayat Inovasyon which was a startup company established by Hayat Holding managing a marketing team performing service of CNG conversions of diesel truck and buses for big fleets.

Jayshri is passionate climate change and sustainability professional with 15+ years of experience in successfully delivering a wide range of climate change, sustainability, and green energy consulting services. She is experienced in developing leads and complex technical projects with multinational companies and organizations such as the World Bank, UNFCCC and UNIDO.

Banu Sinmaz is Environmental Engineer (MSc) with extensive experience in project management, design of water and waste water treatment plants and solutions, feasibility studies for environmental projects.In her previous roles, she was engaged as an Environmental Engineer, in World Bank Project, Sustainable Cities Project Component – A Consultancy Services for Preparation of Integrated Urban Water Management Plan for Selected Cities for Group 2 (Antalya). She was taking care of comprehensive data collection activities, preparation of IUWM plans and strategies within scope of this project.

Banu’s expertise include sustainable water, wastewater, storm water and solid waste management; water treatment, wastewater treatment, solid waste management solutions, sludge drying, energy from sludge and biomass, pure water demand for tribune line of the power plant, project management, procurement of environmental factories, field jobs of environmental facilities, permission of Environmental Ministry, preparation of feasibility of environmental plants, management of budget, import/export of treatment plant, second hand machinery export.

In addition, she is Occupational Safety Specialist, A-Class (2014).She enjoys travelling, sailing and scuba diving.

Veethika is a climate policy specialist managing ClimeTrek’s carbon offset trading desk in London. She has experience in community development implementation and systematic research on environmental certification and climate finance. She is passionate about market-based mechanisms and synergistic systems addressing environmental externalities. In her free time, she enjoys reading and traveling.

Sachin holds a decade of progressive experience working in the HR domain with Industries like Business Process Outsourcing, Insurance, and Think tanks. His areas of expertise include recruitment, induction and orientation, attendance management, performance management, policy designing, employee benefits, and statutory compliances. He is compassionate, energetic, result-driven, and a creative thinker.

He did his master’s in Human Resource Management and Bachelor’s in commerce.

Jing is a part-time Carbon Market Intern at ClimeTrek’s London office. She is currently pursuing her MSc in International Social and Public Policy at LSE. Her dissertation focusses on the development of grassroots social businesses in China, with a particular emphasis on local public policies. Prior to this she studied Social Sciences at Waseda University, Japan.

She has experience with impact analysis of ESG and CSR projects from her past internships in China. Jing is interested in carbon offsetting markets and projects related to sustainable development and community benefits, especially in East Asia.

Her hobbies include learning new languages, baking and travelling..

Holding a BSc in Biological Sciences from the University of Exeter and an MSc in Climate, Change, Development and Policy from the University of Sussex, Inigo’s academic choices were inspired by his commitment to protecting the natural world and an awareness of the challenges it faces.

On the professional front, he has the experience of working as a Research Assistant focused on conservation, research, and environmental education of endangered species for Ecology Project International (EPI) at the Pacuare Reserve in Costa Rica.

Joel is a Nigerian Qualified Lawyer, and an applicant to the Roll of Solicitors of England and Wales. He holds a post graduate specialist degree in International Commercial and Maritime law from Swansea University, Wales, UK. He has strong interests in, and over 18 years cumulative cognate experiences as a legal service provider in the areas of Contracts Management, Commercial Legal Advisory, Regulatory and Corporate Compliance and Litigation.

Joel is an avid reader, he also loves to watch and play football.